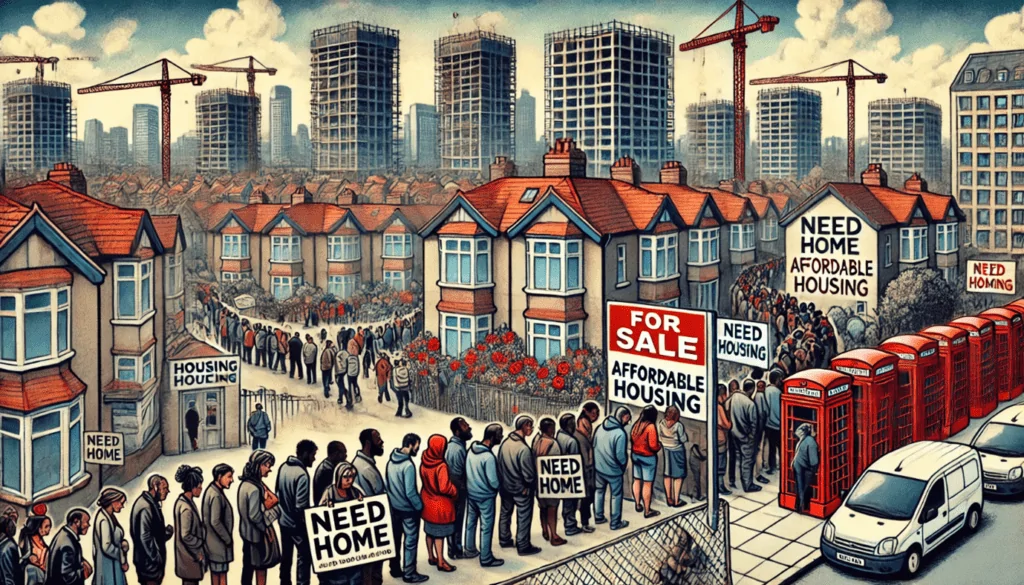

We have a re-elected Labour Government & this is their housing platform.

Labour’s campaign in 2025 placed a heavy emphasis on housing affordability, tenant rights, and social infrastructure. Among the key housing-related policy promises were: Increased investment in social and affordable housing, with a target of building 250,000 new dwellings over the next five years. A review of negative gearing and capital gains tax concessions, aimed at […]

We have a re-elected Labour Government & this is their housing platform. Read More »