Ensuring Compliance with Supplier Payment Obligations

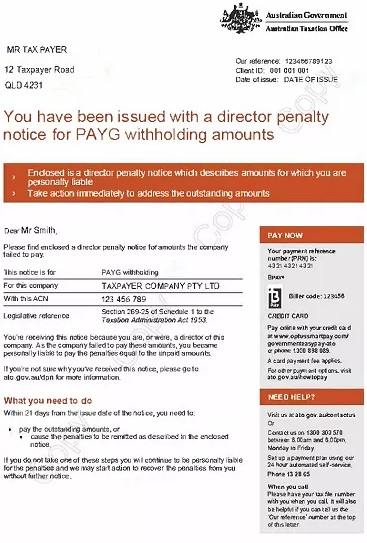

Over the past six weeks, we have encountered two separate incidents where clients have received supplier invoices that may not comply with current tax regulations. One example of such an invoice included wording similar to this: “This organisation is a humanitarian, not-for-profit, tax-exempt, non-government organisation, and as such is not required to quote or hold …

Ensuring Compliance with Supplier Payment Obligations Read More »