If your business meets certain criteria the ATO may disclose your debt information to credit reporting bureaus (also known as credit reporting agencies).

The ATO will not report your debt information to credit reporting bureaus if you’re already engaged with them to manage your tax debts.

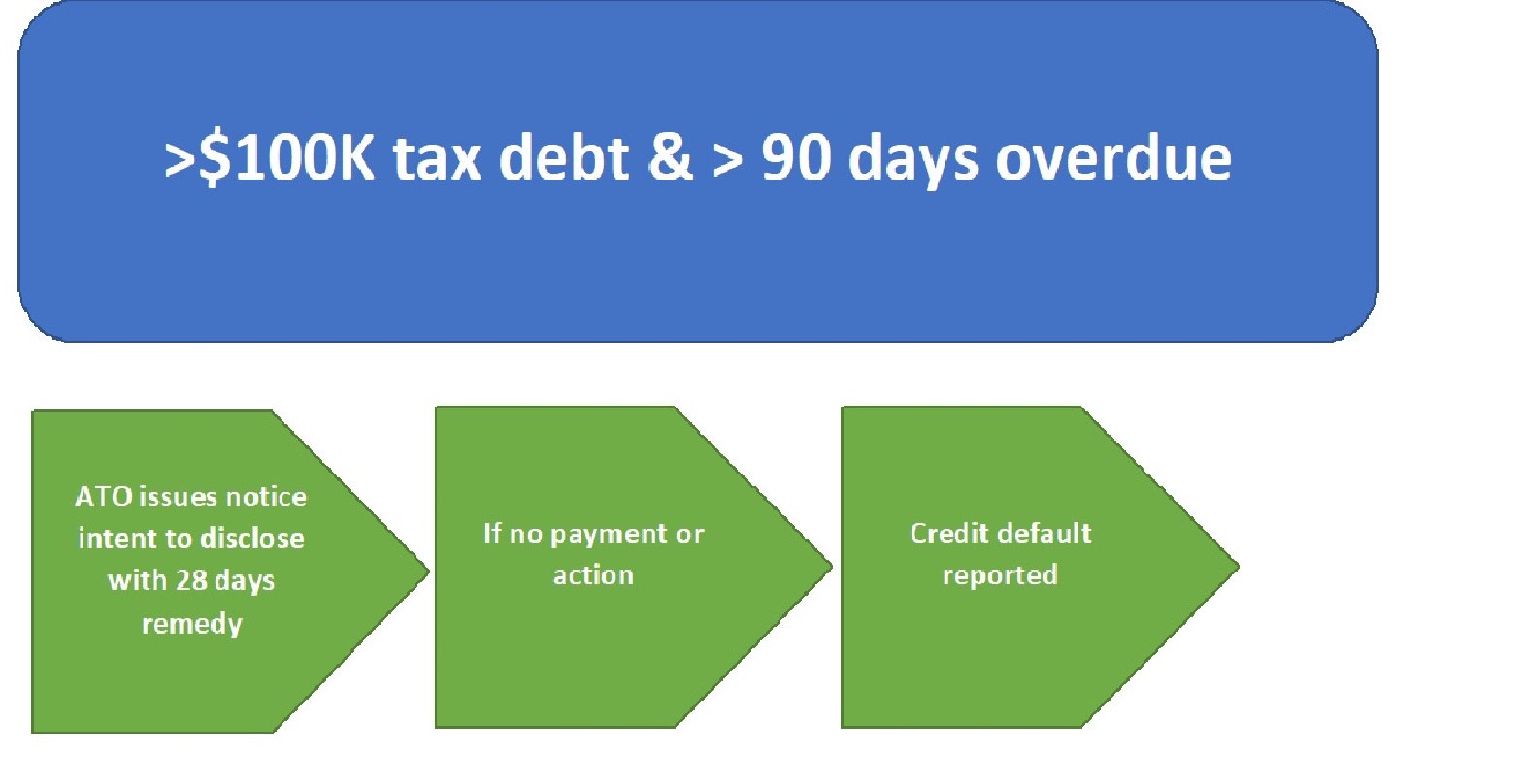

The ATO may report your business tax debit if the following criteria are met:

- You have an Australian business number (ABN) and are not an excluded entity (eg deductible gift recipient, super fund, registered charity or government entity);

- You have one or more tax debts and at least $100,000 is overdue by more than 90 days;

- You are not engaging with the ATO to manage your tax debt eg via a payment arrangement, an application to release debt or a formal objection process;

- You don’t have an active complaint with the Inspector-General of Taxation Ombudsman (IGTO) about our intent to report your tax debt information.

The ATO will send a written notice if they plan to disclose your business’ tax debt.

The notice will tell you about the ATO’s intent to report your tax debt and that you meet the criteria for reporting.

It will also advise the information they intend to report and what steps you can take to avoid your tax debt information from being reported.

You have 28 days from receiving the notice to take the necessary action.

Your tax debt information will be removed with the reporting agency when you no longer meet the criteria.

This occurs when you pay your debt in full or effectively engage with the ATO to manage the debt.

Note this does not prevent parties becoming aware of the initial credit default report (such as customers, suppliers or financiers).

If you receive one of these notices please contact our office immediately to discuss.

We can act on your behalf and begin negotiations with the ATO.