The Australian Taxation Office (ATO) is significantly ramping up its efforts to enforce tax compliance. At Henson Lloyd Accountants, we’ve noticed a sharp rise in the ATO’s requests for Superannuation Guarantee Charge (SGC) statements, the denial of remission requests, and an increasingly strict approach to chasing unpaid debts. This crackdown is particularly focused on company directors who may be held liable for unpaid tax obligations.

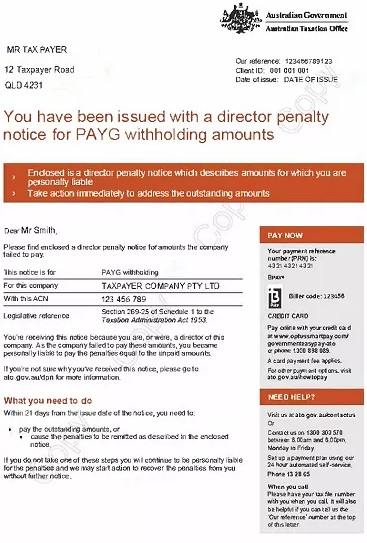

Since July 2023, the ATO has issued over 18,000 Director Penalty Notices (DPNs), amounting to more than $2.5 billion in unpaid taxes.

The Impact of Director Penalty Notices (DPNs)

As a company director, you could be personally liable for a range of unpaid taxes, including Pay As You Go Withholding (PAYGW), SGC, and Goods and Services Tax (GST). This is especially the case when Business Activity Statements (BAS) are late or unfiled. A DPN is a serious notice, indicating that the ATO may take steps to recover unpaid taxes directly from your personal assets.

The DPN will outline the unpaid taxes, penalties, and interest, and will provide options to resolve the debt, including:

- Paying the outstanding amount in full,

- Appointing an administrator,

- Restructuring the company, or

- Winding up the company.

Failure to act on a DPN can have severe consequences, such as garnishee notices (where the ATO accesses bank accounts directly) and legal proceedings.

What Should Directors Do If They Have Outstanding ATO Debts?

If you are a company director with outstanding debts to the ATO, being proactive is key. Here are some steps you should consider:

- Set up payment arrangements with the ATO to manage your debts,

- Lodge SGC statements if you have delayed superannuation payments, and

- Stay up-to-date with upcoming tax obligations to avoid further penalties.

If you receive a DPN, it’s crucial to take it seriously and act immediately. Contact us at Henson Lloyd Accountants to discuss your options and prevent further legal complications.

If you need support with any of the above, please don’t hesitate to contact our office at 8431 1644. We are here to help you navigate these challenges and safeguard your business.